What To Ask

A Guide to Making Informed Insurance Choices

Choosing the right insurance coverage isn’t just about having a safety net for when you become ill—it’s about planning for various life scenarios that each of us might encounter. Understanding what different types of insurance cover can help you make an informed decision that aligns with your life goals and health needs. Here’s a guide on what to consider when selecting your insurance plan.

Navigate Insurance Choices for Every Scenario

Choosing the Right Coverage for Every Scenario of Life

From navigating health challenges to planning for future security, we guide you through selecting coverage that adapts to your evolving needs and ensures peace of mind at every scenario of life.

01.

We Can Help

02.

Understand the Scenarios

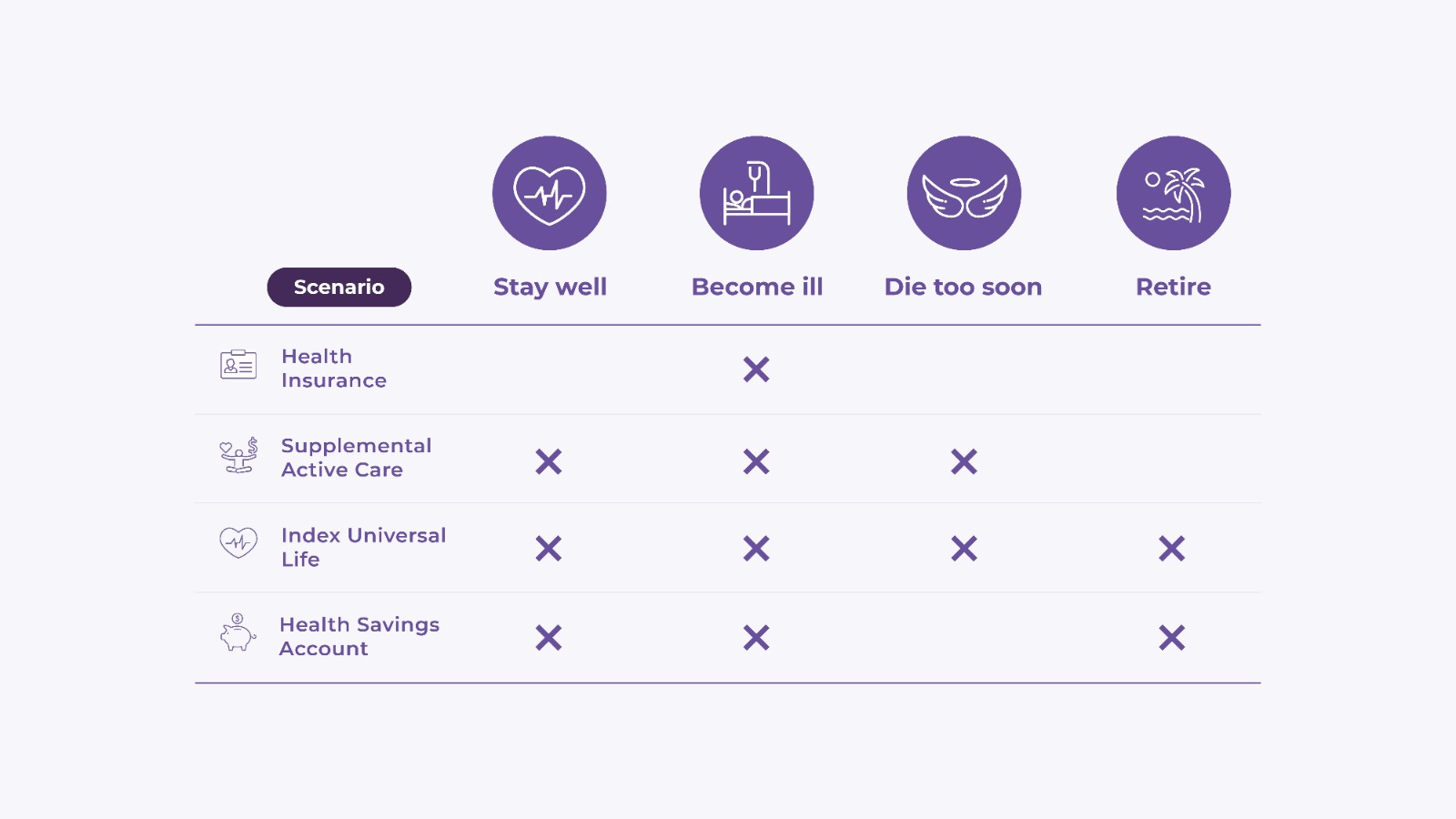

Insurance isn’t one-size-fits-all. It should be tailored to fit different life scenarios:

Staying Well

Maintaining health with preventive care and wellness programs.

Becoming Ill

Handling medical expenses during acute or chronic illnesses.

Dying Too Soon

Providing for your dependents if the worst should happen.

Retiring

Ensuring financial stability and health care in your senior years.

03.

Know Your Insurance Options

Different types of insurance cater to different aspects of these life scenarios:

Health Insurance

Pros:

- Caps your financial risk in case of serious illness or injury

- Limits your choice of healthcare providers to those in the insurance network

- Provides benefits only when you're ill or injured

- Often requires changing plans multiple times in life due to cost or job changes

Supplemental Active Care

- Cost remains fixed, and benefits stay constant

- No restrictions on healthcare provider networks

- Cash benefits paid directly to you, allowing you to spend them on desired care or necessities

- Full premium refund if benefits go unused

- None

Indexed Universal Life Insurance (IUL)

- Fixed cost with increasing benefits

- Tax-free lump sum payout for your family in case of premature death

- Living Benefit: Tax-free acceleration of the death benefit in the event of a major catastrophic or life-altering event, providing cash for immediate needs

- Retirement: Tax-free growth of funds with tax-free withdrawals at retirement

- None

Health Savings Account (HSA)

Pros:

- You own the account

- Lower your taxable income through annual contributions

- Balance grows tax-free

- Use funds to reduce healthcare costs

- Secondary retirement account for healthcare expenses

Cons:

- Tax and penalty on non-healthcare fund usage

04.

Evaluate Your Current Insurance

- Comprehensive Coverage Check: Does your current insurance cover all the scenarios important to you? If you find only the 'becoming ill' box is checked under your current plan, it’s time to reconsider your coverage options.

- Consultation: If your insurance selection does not align with your life scenarios — for instance, if you have only basic health insurance but are concerned about retirement and wellness — we need to discuss how to better meet your needs.

We're Here to Help!

For detailed guidance and to ensure your insurance truly matches your needs across all life scenarios, consider scheduling a consultation. We’re here to help you navigate the complex world of insurance so you can focus on living your healthiest life.